capital gains tax increase 2022

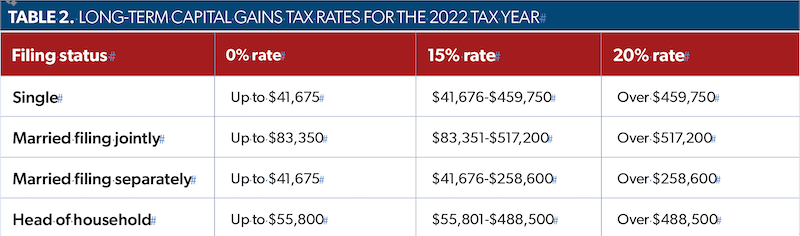

In 2021 and 2022 the capital gains tax rate is 0 15 or 20 on most assets held for longer than a year. Long-term capital gains are taxed at the rate of 0 15 or 20 depending on a combination of your taxable income and marital status.

Capital Gains Tax Rates For 2022 Vs 2021 Kiplinger

The IRS typically allows you to exclude up to.

. President Joe Bidens American Families Plan will likely include a large increase in the top federal tax rate on long-term capital gains and qualified dividends from. A Washington capital gains tax credit for the amount of any legally imposed income or excise. The tax takes effect on Jan.

The new tax rates would therefore apply retroactively from. Since the 2021 tax brackets have changed compared with 2020 its possible the rate youll pay on short-term gains also changed. 250000 of capital gains on real estate if youre single.

When you include the. For single tax filers you can benefit. Extending expanded child tax credit through 2025.

Weve got all the 2021 and 2022 capital gains. Here are the minimum income levels for the top tax brackets for each filing status in 2022. The Finance Act of 2022.

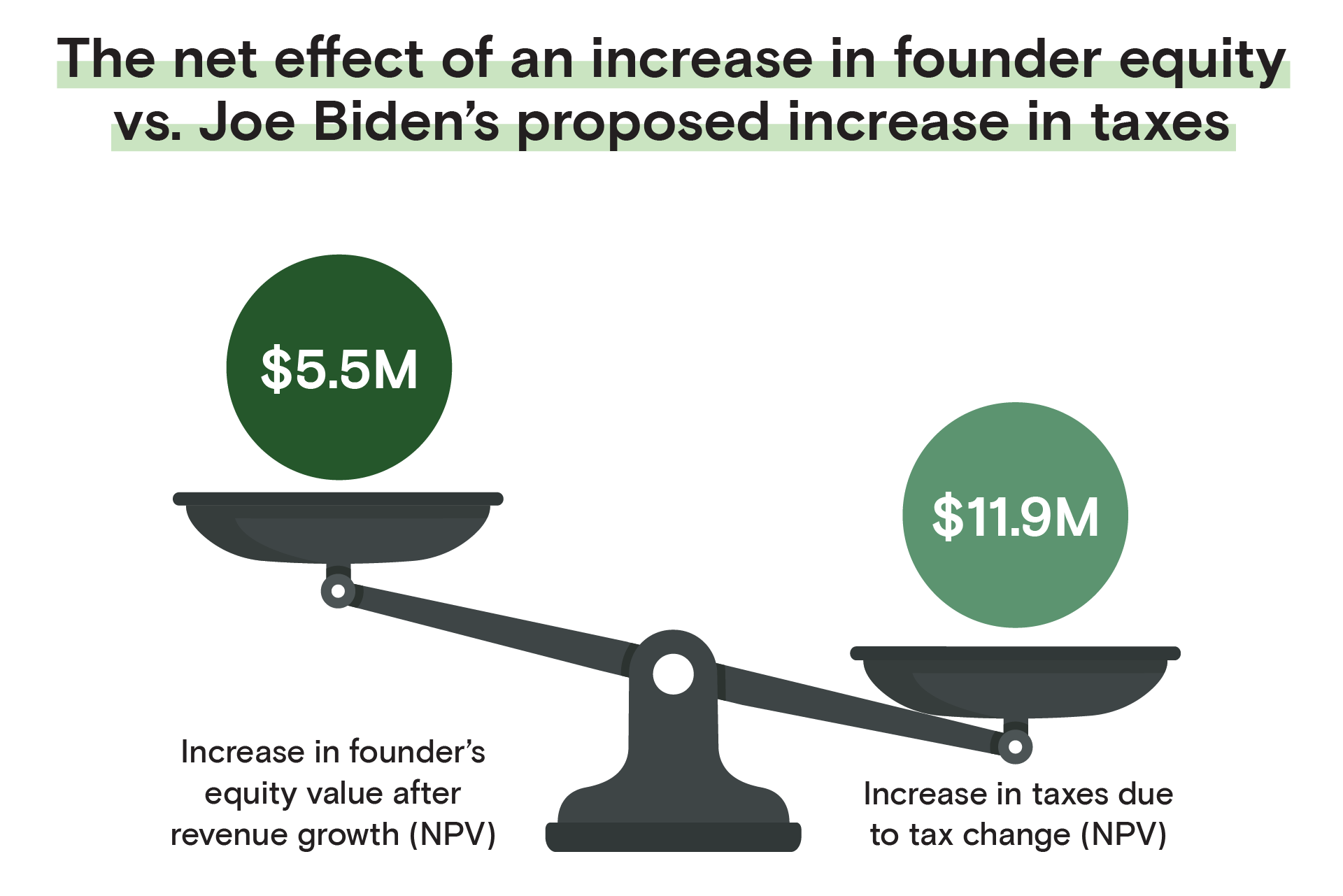

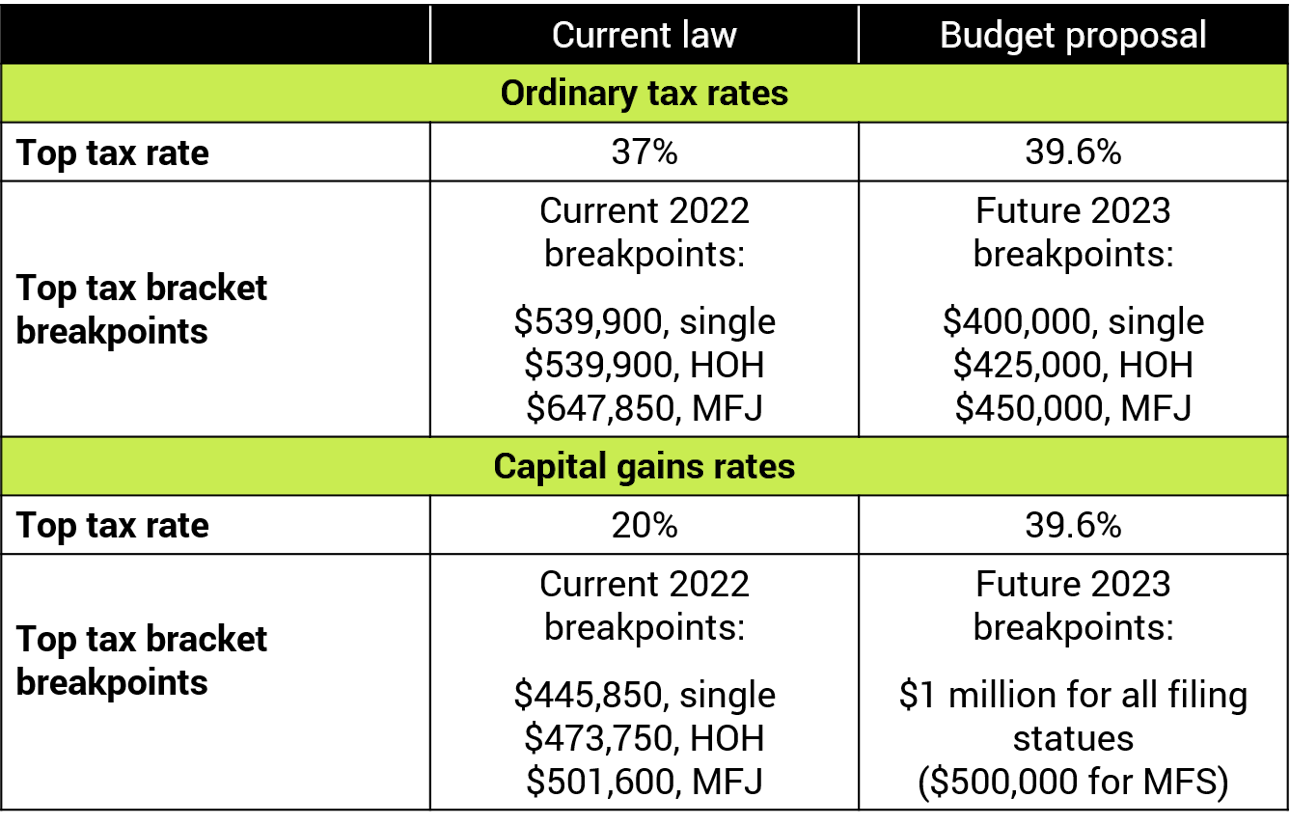

Capital Gains Tax Rates 2021 To 2022. 01 October 2022 - 0400. Bidens Proposed Retroactive Capital Gains Tax Increase 2 weeks ago Jun 14 2021 Biden unveiled a budget proposal Friday June 4 2021 that called for a 396 top capital gains tax.

When your other taxable income. The Guide to capital gains tax 2022 explains how CGT works and will help you calculate your net capital gain or net capital loss for 202122 so you can meet your CGT. Special cases for taxation.

Its time to increase taxes on capital gains. 500000 of capital gains on real estate if youre married and filing jointly. The table below breaks down long-term capital gains tax rates and income brackets for tax year 2022.

Tax Changes and Key Amounts for the 2022 Tax Year. It means that when capital gains taxes most assuredly will increase from the current maximum 20 to 396 in 2022 under the Biden administrations plan you will be. 2022 2023 Capital Gains Tax.

The refundable portion of the Child Tax Credit is adjusted for inflation and will increase from 1400 to 1500 for 2022. Ad Compare Your 2022 Tax Bracket vs. Its time to increase taxes on capital gains.

The expectation of this increase resulted in a 40 increase in. Biden S Proposed Retroactive Capital Gains Tax Increase Ad If youre one of the millions of Americans who invested in stocks. Read The E-Paper.

Instead of a 20 maximum tax rate long-term gains from the sale of collectibles can be hit with a capital gains tax as high. 1 2022 and the first payments are due on or before April 18 2023. The top federal rate would be 25 on long-term capital gains which is an increase from the existing 20.

Business acquisitions accelerate in response to President Bidens plan to double the long-term capital gains tax rate for those at the top from 20 to 40. It also includes income thresholds for Bidens top rate proposal and. In 2023 this gift tax exclusion amount will likely increase from 16000 to 17000.

In 2021 and 2022 the capital gains tax rate is 0 15 or 20 on most assets held for longer than a year. Capital gains tax increase unlikely to deter investors. Capital Gains Tax Rates Brackets Long-term.

This included the increase of GT rates so they were more similar to income tax which was a big problem for anyone looking to sell. Long-term capital gains are taxed at lower rates than ordinary income while short-term capital gains are taxed as ordinary income. 539901 up from 523601 in 2021 Head of Household.

The bill aims to increase the top capital gains rate AND prevent a rush to the exits while the rates are still lower.

Money Matters Irs Increases Standard Deductions For 2022

Capital Gains Tax On Real Estate And Selling Your Home In 2022 Bankrate

What You Need To Know About Capital Gains Tax

/capital_gains_tax.asp-Final-60dadf431693474ba6e99cd1f32440cd.png)

Capital Gains Tax What It Is How It Works And Current Rates

Capital Gains Tax In The United States Wikipedia

How Will Capital Gains Tax Increases In 2022 Impact M A This Year Clearridge

Capital Gains Tax Minimum Wage Increase Among New Laws Taking Effect In 2022 Mynorthwest Com

Capital Gains Tax What Is It When Do You Pay It

President Biden Proposes Tax Changes In Fy 2023 Budget Baker Tilly

9 Ways To Avoid Capital Gains Tax On Commercial Investment Property In 2022 Propertycashin

Individual Capital Gains And Dividends Taxes Tax Foundation

Short Term Capital Gains Tax Rates For 2022 Smartasset

Capital Gains Tax Rate In California 2022 Long Short Term Seeking Alpha

Biden S Fy2023 Budget Proposal Real Estate And Corporate Tax Increases In 2022 Windes

Here S How Much You Can Make And Still Pay 0 In Capital Gains Taxes

Capital Gains Tax On Real Estate And Selling Your Home In 2022 Bankrate

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World